New intermodal record on Polish tracks

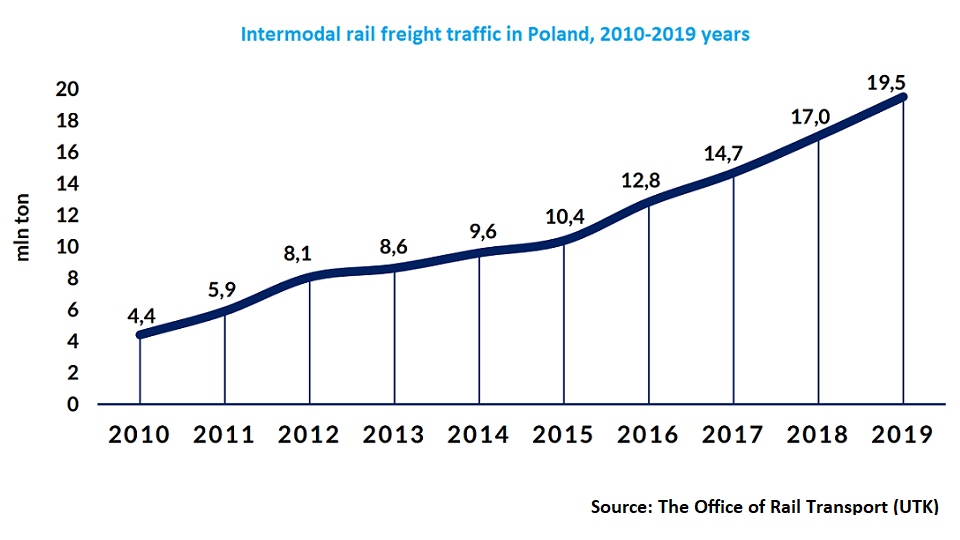

Despite the reduction of bulk volume, intermodal transportation on the Polish railway network is growing. In 2019 the overall rail freight traffic in the country decreased by 5.5 per cent while the intermodal sector set growth of 14.7 per cent. At the same time, the share of intermodal transportation in general rail freight traffic increased from 6.8 per cent in 2018 to around 8.3 per cent last year.

19.5 million tonnes of intermodal freight was carried in 2019 by Polish operators. As in 2018, this sector set a new milestone again. “In 2019 intermodal transportation reached a record level in its history. This means that the freight volumes of intermodal transport in 2019 increased by 14.7 per cent compared to the previous year. Since 2010, the volume of goods transported by intermodal transport increased by more than four times”, said Ignacy Góra, President of the Office of Rail Transport (UTK).

Further growth

UTK noted that there is a possibility for further growth of the intermodal sector, especially in the southern part of Poland. “Taking into account the underdevelopment of a rail infrastructure linking Poland to Czechia and Slovakia, in most cases, trains end their run at the terminals of Lower and Upper Silesia, and the goods to those countries are delivered further by road transport.

“The situation on the country’s southern border requires improvements for trains with higher parameters than the existing ones: the possibility to run for trains with a length of 750 metres and with an axle load of 22.5 tonnes”, the railway body specified.

Text continues below the picture

Competition among operators

In 2019 there were 20 intermodal freight operators on the market. This figure has remained relatively static for the last three years: there were 21 carriers in 2018 and 18 carriers in 2017. Before 2014, this figure was less than 10. Despite these changes, the market leader remained the same. It is PKP Cargo that had a market share of 44.11 per cent in 2019 (compared to 46.46 per cent in 2018). It is followed by two other leading companies that have been ranked second and third for the last two years: Captrain Polska – 13.37 per cent (13.73 per cent in 2018) and PCC Intermodal – 10.59 per cent (10 per cent in 2018).

Three rail freight operators got a market share of over 5 per cent: DB Cargo Polska – 8.41 per cent, LTE Polska – 6.59 per cent, Metrans – 5.01 per cent. Four other companies had a market share of more than 1 per cent: Eurotrans – 2.26 per cent, Ecco Rail – 2.25 per cent, PKP LHS – 1.41 per cent, CTL Logistics – 1.40 per cent. The remaining 10 operators had a share of less than 1 per cent: CD Cargo Poland, Lotos Kolej, ZIK Sandomierz, Rail Polska, STK, Rail Cargo Carrier Poland, Octopus Rail, Karpiel, Transchem, Alza Cargo.

RailFreight Summit Poznan

Do you want to hear more about intermodal transport in Poland and nearby countries? This year’s RailFreight Summit is held in Poznan. Please note that due to the coronavirus, this event has been rescheduled. It is to be held on 1, 2 and 3 September 2020. Registration is now open.

morenews

Networking dinner 1

Networking dinner Networking is the most crucial element of RailFreight Summit! On the evening of 16 April 2024 from 18:00-21:00, a networking dinner will take place. This seated dinner offers the perfect opportunity to get together with your fellow industry professionals in a formal setting. Enjoy a multiple-course dinner, and drinks while making important new… Read more ›

How can this new terminal boost EU-Balkans intermodal transport?

On 19 April, Rihard Dobo will also speak at the RailFreight Summit Poland. He will explain the significance of the Horgos Terminal project and its potential to boost intermodal traffic to and from the Western Balkans and the broader southeast Europe region. The Serbia-Hungary bottleneck “As Serbia and the wider Western Balkan region is not… Read more ›

Malaszewicze upgrade may be financed by Polish government

The EU has in fact decided not to fund the modernisation project planned in the Małaszewicze Transshipment Area. The area includes the terminals Kobylany, Małaszewicze, Bór, and Chotyłów. This project was put on hold, waiting for possible public funds, which now may be on their way. To see this crucial transshipment area with your own… Read more ›